does california have an estate tax or inheritance tax

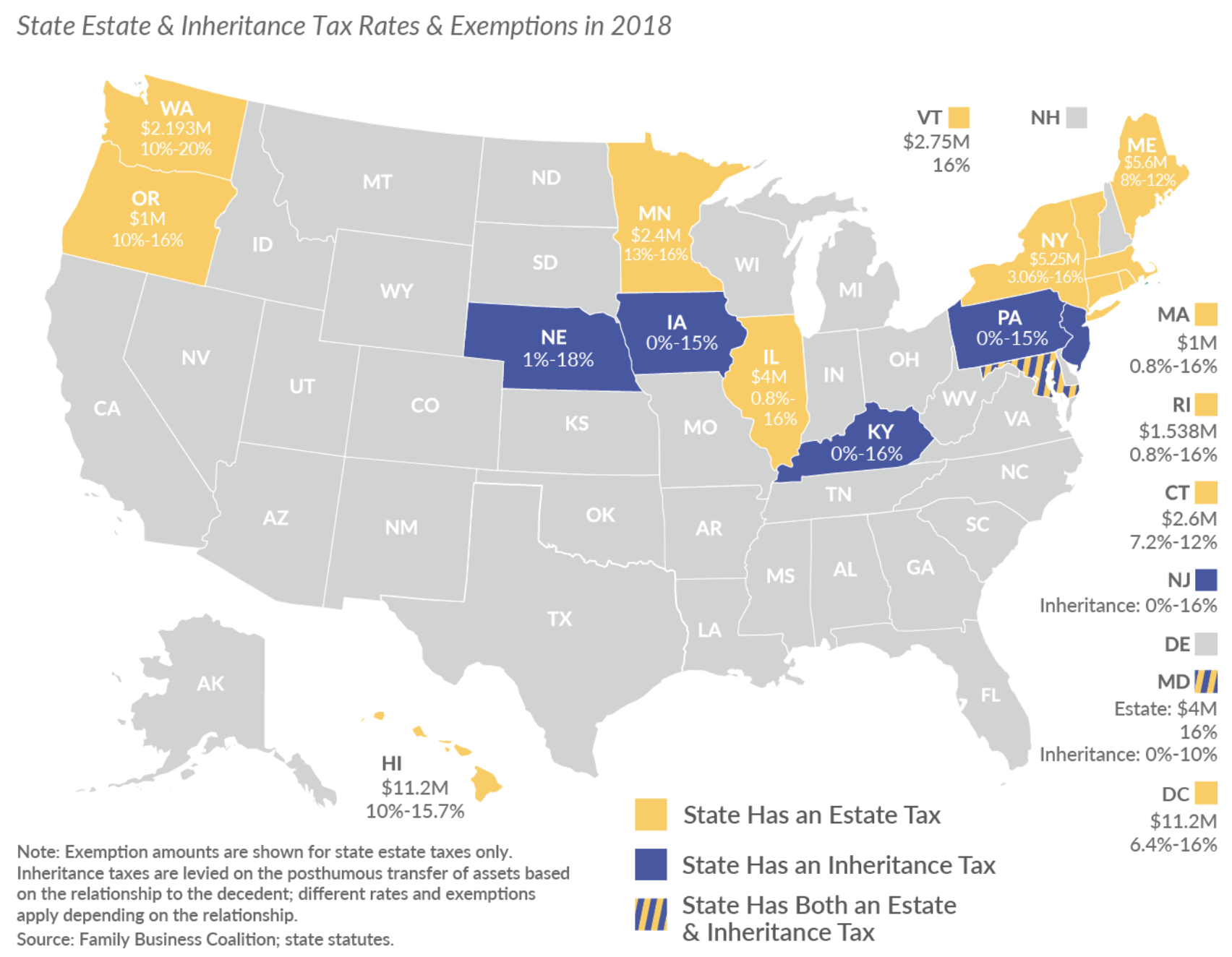

As of 2021 12 states plus the District of Columbia impose an estate tax. California inheritance laws especially when there isnt a valid will in place can get a bit convoluted.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

11 Inheritance tax vs estate tax.

. Does California Have an Estate Tax. However the federal gift tax does still apply to residents of California. Proposition 19 was approved by.

Some states have enacted inheritance taxes on estates of any size. A good girls guide age rating does california have an estate tax in 2021. Does california have an estate tax in 2021.

However the federal government does impose an estate tax on residents of California. Of course this applies to California. As of this time in 2021 California.

As stated above California does not impose taxes on estates or inheritances. There are only 6 states in the country that actually impose an inheritance tax. California is one of the 38 states that does not have an estate tax.

2 How to Avoid Inheritance Tax and Capital Gains. 12 What about capital gains tax. Individuals unrelated to a deceased person however tend to be subject to inheritance tax.

The California Inheritance Tax and Gift Tax As I previously mentioned there is no inheritance tax in California regardless of net worth. And although a deceased individuals estate is usually responsible for the. But the good news is that California does not assess an inheritance tax against its residents.

For 2021 the annual gift-tax exclusion is 15000 per donor per recipient. 1 Federal State and Inheritance Tax on House Rules Explained. How does the California Inheritance Tax Work.

If you are a California resident you do not need to worry about paying an inheritance tax on the money you inherit from a. And if youre thinking of moving consider staying away from Maryland which has both a death tax and an inheritance tax. However there are other taxes that may apply to your wealth and property after you die.

The state of California does not impose an inheritance tax. California does not levy a gift tax. While an estate tax is charged against the deceased persons estate regardless of who inherits what states with an inheritance tax assess it on the.

California Legislators Repealed the State Inheritance Tax in 1981. This means when estate planning the only. No Canada does not have a death tax or an estate inheritance tax.

As of 2021 12 states plus the District of Columbia. There are no estate or inheritance taxes in California. Does California Impose an Inheritance Tax.

This is huge for my California financial. People often use the terms. The federal estate tax goes into effect for estates valued at.

The State of California does not impose an estate tax also known as an inheritance tax. No California estate tax means you get to keep more of your inheritance. Californias newly passed Proposition 19 will likely have major tax consequences for individuals inheriting property from their parents.

Inheritance Tax In California. As the grantor or bequeather paying estate taxes is your responsibility not the heirs or beneficiaries. In California we do not have a state level inheritance tax.

States California doesnt have an inheritance tax meaning that if youre a beneficiary you wont have to pay tax on your inheritance. However an estate must. California doesnt have state-level estate taxes-the federal estate tax.

With the exception of the estate tax for estates exceeding 1158 million dollars per person California does not have a state-level inheritance tax. If you think youll need help with estate planning a financial advisor could advise you on reaching your goals. California is one of the 38 states that does not have an estate tax.

However California is not among them. Like most US. In California there is no state-level estate or inheritance tax.

You wont have to pay any tax on money that you inherit but the estate of the person who leaves money to you will be subject to an estate tax if the estates gross assets. And even for the federal. There really is no tax that would be chargeable to you as a beneficiary for.

That is not true in every state.

California Inheritance Tax Inheritance Tax In California Lawyer Legalmatch

How Is Tax Liability Calculated Common Tax Questions Answered

California Estate Tax Everything You Need To Know Smartasset

California S Tax On Inherited Properties Hurts Minority Communities Calmatters

Taxes On Your Inheritance In California Albertson Davidson Llp

California Estate Tax Everything You Need To Know Smartasset

The Property Tax Inheritance Exclusion

Taxes On Your Inheritance In California Albertson Davidson Llp

What Is An Estate Tax Napkin Finance

How Much Is Inheritance Tax Community Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The Estate Tax On Stocks And Dividends Intelligent Income By Simply Safe Dividends

What Is An Estate Tax Napkin Finance

Estate Tax Examples Of Estate Tax Estate Tax Rate

Is There A California Estate Tax In California Pasadena Estate Planning

How Could We Reform The Estate Tax Tax Policy Center

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Is Inheritance Taxable In California California Trust Estate Probate Litigation